Financial aid definitions: 31 financial terms to know when going back to school

Written by Elizabeth Exline

Reviewed by Chris Conway, Director of Financial Education Initiatives and Repayment Management

If understanding financial aid is like learning a different language, consider the following guide your personal primer.

We’ve compiled 32 of the most salient terms pertaining to financial aid, from the seemingly obvious (what is a grant anyway?) to a variety of student loans whose names are disarmingly similar, but whose meanings are decidedly not.

Here's what you need to know.

What is financial aid?

Let's start with the basics — defining financial aid. Federal Student Aid (FSA) is an office within the U.S. Department of Education that provides financial aid to students in the form of grants, work-study funds and student loans. The purpose is to help make a college education more affordable.

If you have additional questions on how federal student aid works or how to get started, click here to check out our federal student aid FAQ at phoenix.edu.Ěý

32 financial aid terms you need to know

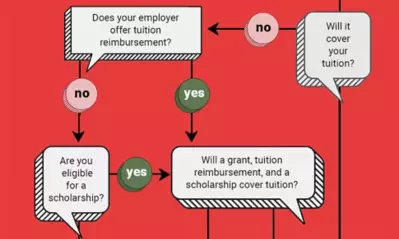

Now that you know the basics of financial aid, let's cover a few terms you should know to help you make an informed decision about your financial needs. Most people are aware of student loans, but there many other financial aid options to help make school more affordable. These can include federal student aid offerings provided by the federal government as well as tuition assistance, like scholarships, offered by an institution.Ěý

Read on for 32 financial aid terms you need to know.Ěý

Academic year

An academic year is one complete school year at the same school. For schools that have a year-round program of instruction, nine months is considered an academic year.Ěý

Cost of attendance

This is what it will cost to go to school, and it should include financial aid expenses like tuition, food and housing, transportation, books and supplies, federal student loan fees, miscellaneous personal expenses, dependent care expenses and disability related expenses. Most colleges and universities calculate this cost on a per-school-year basis.

Default

To default is to fail to repay a loan according to its terms.

For federal student loans, the period between a payment’s due date and being considered in default is usually generous at about 270 days. After that, students may incur legal consequences and be ineligible for additional federal student aid.

Deferment

A permissible and temporary postponement of loan payments. Deferments are subject to certain criteria, and interest may still accrue on the loan during the payment hiatus (unless it’s for subsidized federal loans).

Direct consolidation loan

Juggling a lot of loans? A direct consolidation loan may help save you the headache of managing multiple due dates and interest rates. By completing the Federal Direct Consolidation Loan Application and Promissory Note, and then agreeing to the terms of the direct consolidation loan, you can make one monthly payment on everything.

Direct PLUS loan

Two groups of people are eligible for these federal loans: parents of dependent undergraduate students and graduate or professional students.

Direct subsidized loan

A federal student loan on which the government pays the interest while the borrower is in school or in a grace or deferment period.

Direct unsubsidized loan

A loan for which the borrower must cover the interest, regardless of the loan status. (This is different from the direct subsidized loan.)

Disbursement

A disbursement is the payment of federal student aid funds, grants or loans to a student by the school. Students will generally receive two or more disbursements in an academic year.Ěý Any excess financial aid money is then paid to the student via check or direct deposit.

Discretionary income

Discretionary income is a factor used in determining a borrower’s eligibility for certain repayment plans and/or loan rehabilitation. It is calculated by determining the difference between a borrower's annual income and a percentage of the poverty guidelines for the borrower’s family size and state of residence.

Extended repayment plan

Just as the name promises, this repayment plan lets eligible students repay their loans over a span of up to 25 years.

Federal Pell Grant program

Available to low-income households, the Pell Grant is the largest federal grant program offered to undergraduates. It doesn’t usually have to be repaid.

Federal student aid

Federal student aid refers to offerings like grants, loans and work-study programs facilitated by the federal government and designed to help students pay for college or career school.

Federal Supplemental Educational Opportunity Grant

Available to undergraduate students with demonstrated financial need, this grant does not need to be repaid and can range from $100 to $4,000.

Free Application for Federal Student Aid (FAFSA')

is the foundation for financial aid. You need to fill out a free application for federal student aid to apply for financial aid, such as for student loans, grants and scholarships. It’s important. Get familiar.

Forbearance

A period of time when you can skip or reduce your monthly loan payments toward financial aid. While this break can sometimes be necessary, it can also add a financial burden later on: Interest continues to accrue on loans during forbearance periods, and unpaid interest may be added to the loan principal (or “capitalized”) at the end of the forbearance period.

Graduated repayment plan

Work up to paying off your student loans with this program, which begins with lower payments that increase every two years, presumably as your income increases. You’ll have up to 10 years to pay everything off or, if you apply for a consolidated loan, up to 30 years.

Grant

Grants are funds that don’t have to be repaid, so long as the student meets certain criteria. Grants are a monetary gift for people pursuing higher education.

Income-based repayment (IBR) plan

For students who pursue low-paying jobs, have low income as compared to their debt or who are experiencing financial difficulty, this loan repayment plan caps the monthly payments at a percentage of their discretionary income. It is available to borrowers who have participated in select loan programs.

Income-contingent repayment (ICR) plan

A repayment plan available to borrowers who have a direct loan that’s not in default or a parent PLUS loan. Through this repayment program, monthly payments are based on either:

- 20% of your discretionary income and divided by 12

- What you would pay on a repayment plan with a fixed monthly payment over 12 years and adjusted based on your income

To be eligible, a borrower must have already made 120 payments as part of the direct loan program.

Independent student

Are you financially independent? You are if you’re a student who is at least 24 years old, married, a graduate/professional student, a veteran, a member of the armed forces, an orphan, a ward of the court, someone with legal dependents (not a spouse), an emancipated minor or someone who is at risk of becoming homeless.

Judgment lien

A court can use a judgment lien to give a creditor the right to a borrower’s property when the borrower fails to pay back a loan.

Master promissory note (MPN)

Also known as a loan agreement, an MPN documents the terms of your loan. It is legally binding, and it contains both the borrower’s rights and responsibilities as well as the conditions for repayment.

Net price calculator

Available on a college’s website, this online tool helps prospective students understand what attending a given school will cost.

Outside scholarship

A scholarship awarded by an entity outside of the school or federal or state government. Scholarships are gifts and don’t have to be repaid.

Pay as you earn (PAYE) plan

A repayment plan with monthly payments that are 10% of your discretionary income but less than the 10-year standard repayment plan amount.

PLUS credit counseling

Before you sign on the dotted line of a direct PLUS loan, seek out this service for a thorough understanding of the terms and obligations involved.ĚýÂ under certain conditions but is otherwise voluntary.

Public Service Loan Forgiveness program

The remaining balance of your direct loan(s) can be forgiven after you make 120 qualifying payments under a qualifying repayment plan, and while you’re working full time for a qualifying employer (such as a governmental, tribal or nonprofit organization).

Principal

The amount of money initially borrowed toward financial aid or that’s remaining on a loan. Interest is based on this amount and charged as a percentage.

Satisfactory academic progress

This process is used by schools to determine if a student is on track to graduate on time with their selected degree or certificate. Students are required to maintain satisfactory academic progress to remain eligible for federal student aid. This process may vary from school to school.

Scholarships

A scholarship is a form of financial aid awarded to a student by a school, university, organization or other entity to help them further their education. Scholarships can be awarded based on a number of criteria, such as merit, academic or athletic achievement, need, and diversity and inclusion. The recipient doesn’t need to repay most scholarships, but they are often required to maintain the specific requirements, such as GPA.

Are you ready to get started? Discover how °®ÎŰ´«Ă˝ could help you save time and money toward a degree. Visit phoenix.edu.Ěý

ABOUT THE AUTHOR

Elizabeth Exline has been telling stories ever since she won a writing contest in third grade. She's covered design and architecture, travel, lifestyle content and a host of other topics for national, regional, local and brand publications. Additionally, she's worked in content development for Marriott International and manuscript development for a variety of authors.

ABOUT THE REVIEWER

As Director of Financial Education Initiatives and Repayment Management, Chris Conway works with departments across the University to provide resources that allow students to make more informed financial decisions. She is also an adjunct faculty member for the Everyday Finance and Economics course at the University, and she chairs the National Council of Higher Education Resources College Access and Success Committee. Conway is committed to helping college students make the right financial decisions that prevent future collection activity.

This article has been vetted by °®ÎŰ´«Ă˝'s editorial advisory committee.Ěý

Read more about our editorial process.

Read more articles like this: